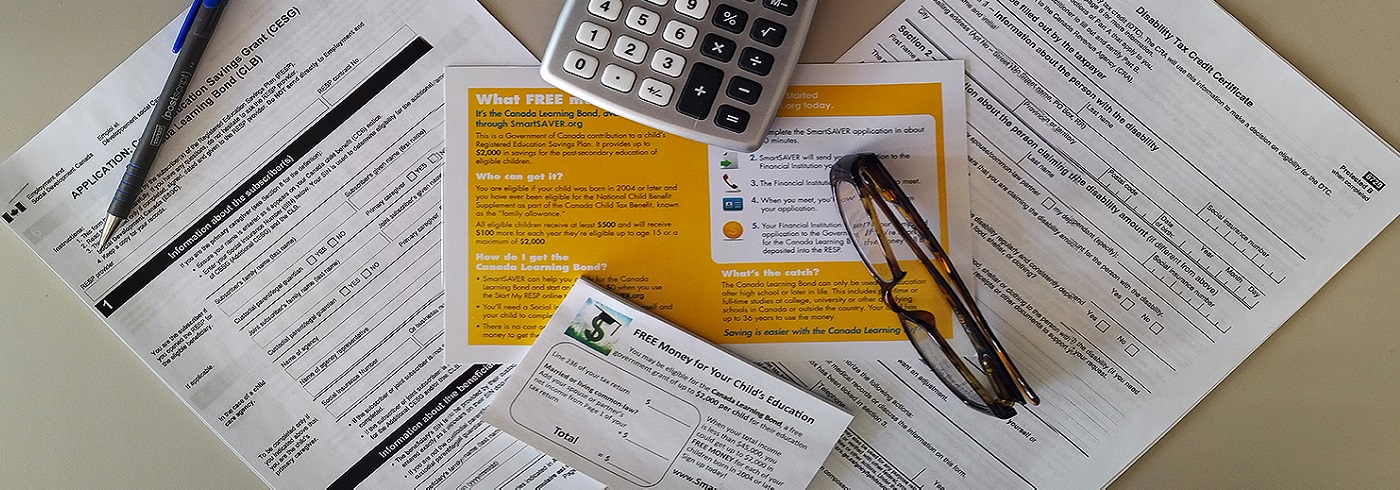

File Your Taxes

Boost your income by filing your taxes

If you are living with low income and have a simple tax situation, you can file your income tax for free, year-round.

Why is filing taxes important? Residents living with low income or no income can access benefits through tax filing. Watch a video to learn more about how filing taxes can help to boost your income.

Find a local clinic where your income taxes will be prepared and e-filed by a certified community volunteer.

Find a local income tax clinic

| Find out if you are eligible to use a free tax clinic |

Income thresholds:

Note: Organizations can modify the total family income based on the local economic environment, the population they serve, and their resources. Community organizations may also establish additional criteria. When is a tax situation simple? A tax situation is considered simple if an individual has no income or if their income comes from:

When is a tax situation not simple? A tax situation is not simple when an individual:

|

| Income and benefits programs available through filing income tax |

|

In Ontario, there are 41 income and benefits programs that can only be accessed by filing income tax. These include benefits like:

These benefits can increase annual income and are only available if taxes are filed every year. |

|

Do you need identification so you can file your taxes? |

|

You must have a Social Insurance Number (SIN) in order to file your taxes. You will need a birth certificate to get a Social Insurance Number. Do you need a birth certificate? Birth certificates can be ordered directly from the Province of Ontario: Online Certificate Application (gov.on.ca). There is a fee for the certificate and you will need a credit card or a Visa Debit card in order to pay the fee. If you need help with the online birth certificate application and/or paying the fee, identification (ID) clinics for birth certificate applications are held from 8:30 to 11 a.m. on the last Monday of each month at John Howard Society (JHS) offices in Durham Region. Please bring a completed Birth Certificate application and proof of income to the ID clinic for help with getting a birth certificate. Do you need a Social Insurance Number? Once you have a birth certificate, you will be able to get a Social Insurance Number from Service Canada. It is free to get a Social Insurance Number. You can apply online: Social Insurance Number – Apply - Canada.ca or visit a Service Canada office in person. Learn about the documents you will need to apply for a Social Insurance Number: Social Insurance Number: Required documents - Canada.ca. If you would like to talk to someone about applying for a SIN, you can request a phone call from a Service Canada representative by completing a form: eServiceCanada - Service Request Form. Attend a Mobile ID and Benefits Access Hub to get help with getting identification. Learn more: Mobile Benefits Hubs - Region of Durham Attend an ID Replacement Clinic for help with getting/replacing a birth certificate or a purple Ontario ID Card. Visit CDCD's Events page for details. |

Find more information about filing your own taxes independently

You can find information and resources about filing your taxes yourself from the Government of Canada, including information about ways to file your taxes and links to certified tax software online. Register for a free webinar at Upcoming events - Canada.ca.

Missed a webinar or can’t make the broadcast? Past webinar recordings are posted on Outreach materials to print and share - Canada.ca. Past webinar topics have included scam awareness, the disability tax credit, and more.

The Ontario Ministry of Finance offers webinars on a variety of tax filing topics, including the Ontario Medical Expense and Seniors Care at Home tax credits. Information about upcoming webinars can be found at Ministry of Finance Tax Talk information sessions | ontario.ca. Webinars are held several times per month.

Learn about your taxes is an online learning tool to help people understand how the Canadian tax system works. This resource seeks to demystify taxes, empowering individuals by teaching them how to do their personal taxes, and to increase awareness of available benefits and credits.

Find tax information for:

Find a local income tax clinic

| Income Tax Clinics in Ajax |

Ajax Public Library55 Harwood Avenue South, Ajax

Please contact the library to make an appointment

Ajax Welcome Centre458 Fairall Street, Ajax, Unit 5 - clinic located on the east side of the Ajax GO Station

Languages spoken: English, Dari, Farsi, Farsi/Persian, Gujarati, Hindi, Pashto, Urdu Please call to make an appointment:

CADJPro Tax Clinic157 Harwood Avenue North, Unit 224, Ajax

Complete form to make a tax filing appointment: Volunteer Clinic — CADJPro

CDCD Housing Tax Clinic458 Fairall Street, Ajax, Unit 4 - clinic located on the east side of the Ajax GO Station

Languages spoken: English, French, Arabic, Dari, Farsi, Hindi, Spanish, Tamil Please call to make an appointment:

CVITP Tax ClinicClinic is virtual only - no street address

To make an appointment: Diverse Financial Group Tax Clinic27-520 Westney Road South, Ajax (inside JH Party Rentals)

***We can prepare all levels of Income Tax - SW and HT friendly*** To make an appointment:

Ontario Works Locations - Year-RoundThe Income, Employment and Homelessness Supports Division (IEHSD) can provide tax filing for Ontario Works (OW) recipients. Tax filing is provided through Drop-Off Tax Clinic Services only. Ontario Works clients can contact the following staff at their OW office for more information. Ajax Ontario Works Office For tax filing packages and information, contact the Ajax Ontario Works office:

|

| Income Tax Clinics in Clarington |

Clarington Library, Museums & Archives (CLMA)Bowmanville Library - 163 Church Street, Bowmanville

Clarington Library, Museums & Archives (CLMA)Newcastle Library - 150 King Avenue East, Newcastle

CVITP Tax ClinicClinic is virtual only - no street address

To make an appointment: Welcome Centre Income Tax Clinic Oshawa/Clarington200 John Street West, Unit B9, Oshawa (inside Midtown Mall)

To make an appointment:

|

| Income Tax Clinics in North Durham (serving Brock, Scugog and Uxbridge) |

CVITP Tax ClinicClinic is virtual only - no street address

To make an appointment: North House2-B Elgin Park Drive, Uxbridge

Please contact us to make an appointment:

Ontario Works Locations - Year-RoundThe Income, Employment and Homelessness Supports Division (IEHSD) can provide tax filing for Ontario Works (OW) recipients. Tax filing is provided through Drop-Off Tax Clinic Services only. Ontario Works clients can contact the following staff at their OW office for more information. Uxbridge Ontario Works Office For tax filing packages and information, contact The Uxbridge Ontario Works office:

|

|

Income Tax Clinics in Oshawa |

Conseil des organismes francophones de la région de Durham (COFRD)2D - 57S Simcoe Street South, Oshawa

Languages spoken: English, French To make an appointment:

CVITP Tax ClinicClinic is virtual only - no street address

To make an appointment: Ontario Works Locations - Year-RoundThe Income, Employment and Homelessness Supports Division (IEHSD) can provide tax filing for Ontario Works (OW) recipients. Tax filing is provided through Drop-Off Tax Clinic Services only. Ontario Works clients can contact the following staff at their OW office for more information. Oshawa Ontario Works Office For tax filing packages and information, contact Kelly Spurs:

I know that lots of clinics offer a virtual option for tax filing, so I think a work from home arrangement is probably something that could work. Oshawa Public LibrariesJess Hann Branch - 199 Wentworth Street West, Oshawa

To make an appointment:

Oshawa Public LibrariesMcLaughlin Branch - 65 Debwewin Miikan, Oshawa

To make an appointment:

Welcome Centre Income Tax Clinic Oshawa/Clarington200 John Street West, Unit B9, Oshawa (inside Midtown Mall)

To make an appointment:

|

|

Income Tax Clinics in Pickering |

CVITP Tax ClinicClinic is virtual only - no street address

To make an appointment: Muhammad's Community Tax ClinicPickering (please contact clinic for address)

Languages spoken: English, Hindi, Punjabi, Urdu Please email to make an appointment or call during office hours:

Pickering Public LibraryOne the Esplanade, Pickering Drop-in clinic (no appointments required - first-come, first-served) running on the following dates:

Welcome Centre Immigrant Services, Pickering3 - 1410 Bayly Street, Pickering

To make an appointment:

YMCA Pickering Free Tax ClinicYMCA Pickering Office: 1550 Kingston Road, Unit 16, Pickering

Register today!

|

|

Income Tax Clinics in Whitby |

CVITP Tax ClinicClinic is virtual only - no street address

To make an appointment: Ontario Works Locations - Year-RoundThe Income, Employment and Homelessness Supports Division (IEHSD) can provide tax filing for Ontario Works (OW) recipients. Tax filing is provided through Drop-Off Tax Clinic Services only. Ontario Works clients can contact their OW office for more information. Whitby Office For tax filing packages and information, please email: whitbyowtaxclinic@durham.ca or call 905-666-6239 ext. 2722.

|

Contact Us